It’s no secret that things have slowed down significantly. Inventory is piling up as buyer demand remains extremely low. However, not all hope is lost—there are still some segments of the market that are thriving!

In this month’s market report, we’ll highlight the areas that are performing well, while diving into the numbers on inventory, interest rates, buyer demand, and housing prices.

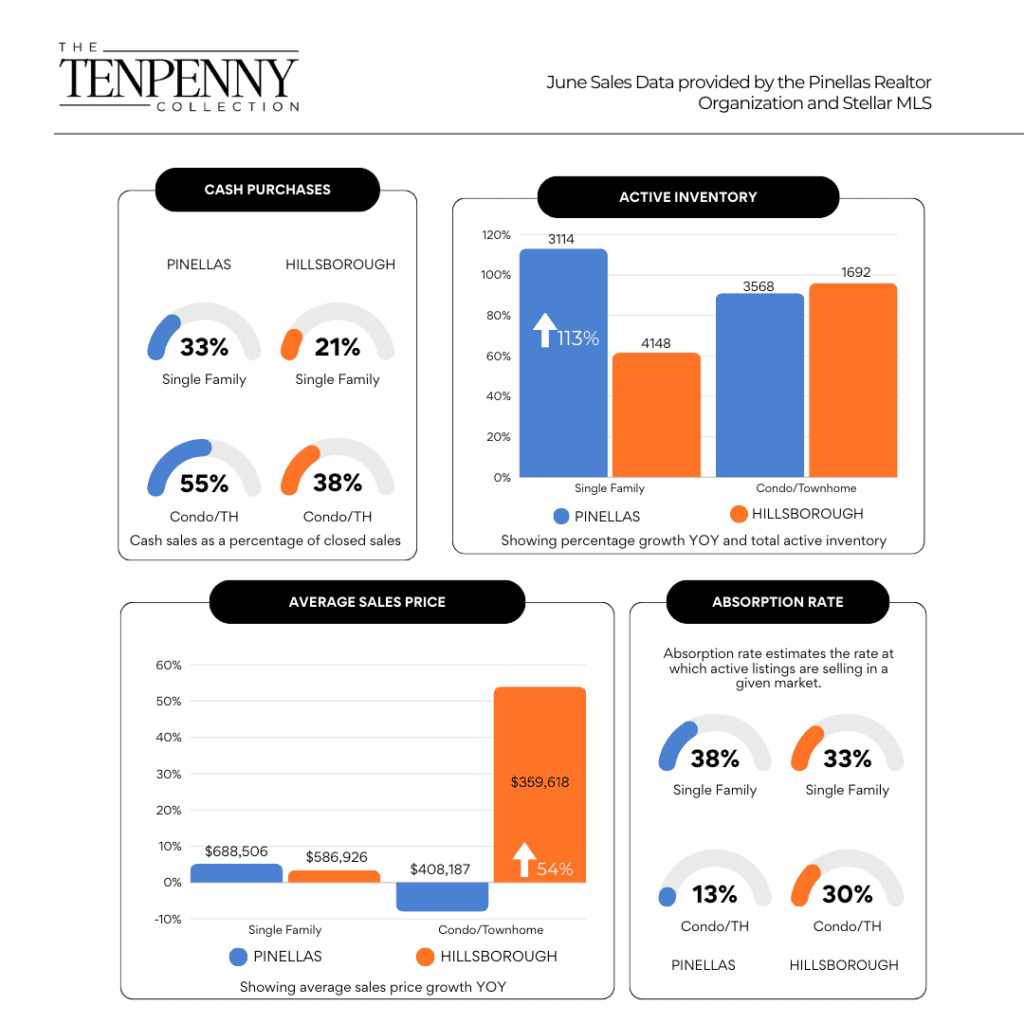

Surprisingly, it’s the condo market that’s been making waves. In Tampa (Hillsborough County), the average sales price for condos surged from $386K to $586K year-over-year (YOY), marking a 54% increase!

This unexpected rise in condo prices, after months of stagnation, caught my attention. Here’s a closer look at what’s driving this increase:

Across the bridge in St. Petersburg – Clearwater (Pinellas County), condo sales of $3-4m experienced the highest demand of buyers, with a 28.5% absorption rate. This price bracket was the highest of all price ranges for condo sales in Pinellas.

Three points of clarification:

Before we go further, let’s define a critical term: Absorption Rate.

The absorption rate is a straightforward way to gauge buyer demand. It measures how many homes are being “absorbed” out of the market. When the absorption rate is high, buyer demand is high; when it’s low, buyer demand is low. A healthy market typically has an absorption rate of around 50%.

For example, in June, the condo market in Pinellas County had a modest 16% absorption rate, meaning buyers purchased only 16 of every 100 properties available for sale.

As we reported last month, inventory is on the rise. However, the number of new listings per week has not drastically increased. The increase in active inventory is due to a lack of buyer demand – a.k.a buyers absorbing these listings from the market.

In St. Petersburg – Clearwater the active inventory is up 113%. There are currently 3114 single-family homes on the market. In June, the average sales price increased 5.4% YOY to $688,506.

Tampa’s average sales price rose a 3.4% YOY to $586,926. Inventory in Tampa is up 63% with 4148 homes currently available for sale.

Buyers are sitting on the sidelines waiting for 3 things to happen:

Good news! Interest rates have dropped. The average 30-year fixed interest rate was down to 6.40% at the beginning of August, the lowest in over a year.

We expect interest rates to drop lower over the next few months.

Unfortunately for buyers hoping for significant price drops, home prices aren’t expected to fall anytime soon (or at all). However, the rate of price increases has slowed to a more typical 3-4% annualized growth.

Sellers now face more competition, which will likely create downward pressure on pricing. The days of “testing” the market are over—buyers now have more selection and time to make informed decisions. They’re looking for homes that are not only cosmetically appealing but also have upgraded major mechanical components. Essentially, they want everything, they’re willing to wait for it, and they are not willing to put the work into it.

This is perhaps the most frustrating factor, as we hear this excuse nearly a year before the election. The reality is that the incumbent doesn’t take office until three months after the election, and it takes another 3-6 months for any substantial changes to occur. This means we’re looking at 18-24 months of uncertainty.

It’s also important to point out that real estate prices have increased in seven of the last eight Presidential election cycles—the only exception being the Great Recession, which wasn’t election-related.

Unfortunately the data we are sharing is from June, yet it is already August. July did not show an increase in activity but we are already seeing a slight impact from the recent drop of interest rates. More homes went pending in the past week than the several weeks prior.

Please visit our YouTube channel for videos about the housing market and to tour our luxury properties for sale.

You can also follow up on Instagram, Facebook, or Linkedin for weekly market updates.

We hope you found this information useful. If you are seeking additional information about the Tampa Bay Real Estate Market, please connect with us today or call directly (727)308-1669.