The Fed has cut interest rates twice in 2025, and many buyers and sellers are still waiting for a third cut in December before they make a move.

Here’s the twist almost nobody outside of the mortgage world is talking about:

Each time the Fed has cut rates this year, 30-year mortgage rates have actually gone up.

In this article, we’ll unpack why that’s happening, what it means for affordability in Tampa Bay, and how new ideas like the 50-year mortgage compare to more traditional tools like ARMs and rate buy-downs.

We’ll also look at what’s happening at the higher end of the market and whether Tampa Bay is still in a “K-shaped” economy—or if that K is finally starting to soften.

The Fed controls short-term rates (like credit cards and car loans), but mortgage rates are long-term and are driven mainly by investor behavior in the 10-year Treasury bond market—not the Fed’s rate directly.

When the Fed speaks, big institutional investors are listening for one thing: how confident or uncertain the Fed sounds about the economy. That emotional read, not the headline rate cut, is what often moves mortgage rates.

This is why you can see headlines like:

“Fed cuts rates!” and at the same time, “Mortgage rates rise.”

Different part of the financial system. Different drivers. So what drives the mortgage rates?

Mortgage rates rise and fall based on investor sentiment.

If the Fed’s announcement leaves investors feeling UNCERETAIN about market conditions, Investors buy safer assets like the 10-year Treasury.

If the Fed’s announcement leaves investors feeling CONFIDENT about the economy, investors sell the Treasury Bonds and put money into riskier assets – like stocks.

These are not everyday homebuyers. They are large institutions that move billions of dollars at a time:

When they change course, they move the 10-year Treasury market, and that, in turn, moves mortgage rates.

Essentially, these institutional investors need to feel UNCERTAIN about the economy and buy more Treasury bonds so we can afford a home.

A 50-year mortgage lowers the monthly payment, but it dramatically increases total interest paid and slows down equity building.

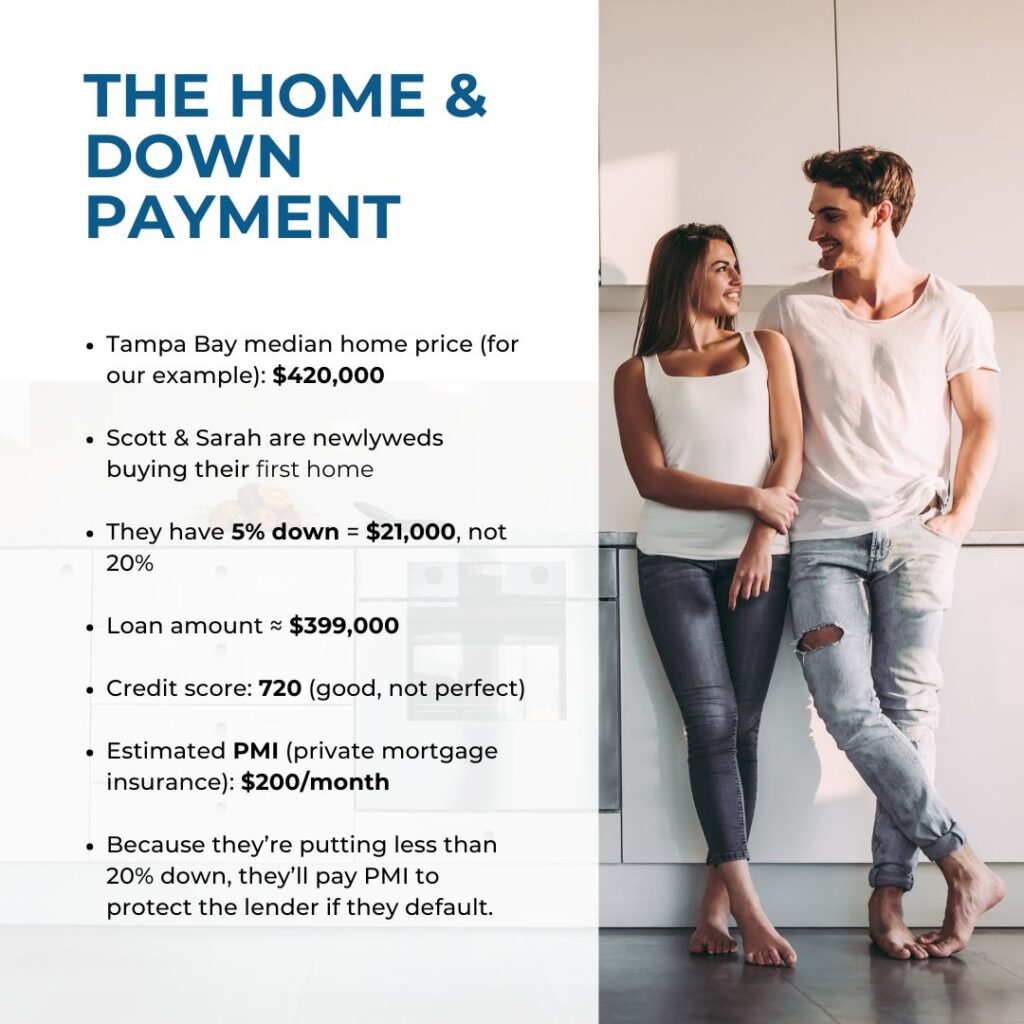

The idea of a 50-year mortgage has been promoted as one potential response to the housing affordability crisis, including by Bill Pulte, Director of the Federal Housing Finance Agency (FHFA) and grandson of the founder of Pulte Homes. Whether you love it or hate it, it’s important to understand what it actually does to the numbers.

Typically:

Example rate assumptions:

Using the example rates:

On the surface, that lower payment looks great, especially to a young couple watching every dollar.

Here’s where the 50-year mortgage becomes dangerous if you don’t look past the monthly payment.

Approximate totals over the life of the loan:

And because early payments are heavily weighted toward interest, with a 50-year loan, it can take around 25 years before the owner has 20% equity.

For a true “forever home” where someone plans to live 40–50 years, maybe that trade-off is acceptable. However, most first-time buyers don’t stay that long. It is a “starter-home,” not a “forever-home”.

In this case study, since the couple is purchasing a starter home, they expect to sell in 5–7 years. That changes the conversation and opens the door for other options.

A 5/1 ARM (adjustable-rate mortgage):

In our example:

So the ARM doesn’t beat the 50-year loan on the monthly payment, but it avoids the extremely long-term interest and painfully slow equity growth.

Important context:

The ARMs that caused problems in the mid-2000s were often paired with subprime lending and lax bank regulations. Today’s ARMs are under much stricter regulations and can be a smart tool when the time horizon matches the fixed period (e.g., 5–7 years in the home with a 5-year fixed term).

Of all the options, one of the most powerful and most underused is a rate buy-down.

This is the exact tool many national homebuilders are using when you see ads like “3.99% interest” on new construction. These national builders do not have a special bank they use. Instead, they are buying down the rate to incentivize buyers.

In this scenario

Impact on monthly payments:

That’s a monthly savings of about $254, which is very close to the savings from the 50-year loan, but without taking on 50 years of interest and ultra-slow equity.

There are two main options:

For many buyers, especially first-timers, a rate buy-down paired with a 30-year fixed offers a powerful balance of lower payment, solid equity growth, and long-term stability.

The chart belows all of the payment options discussed in this case study.

From 2020 through 2024, Tampa Bay showed a very clear K-shaped pattern in housing. Luxury sales surged upward while lower-priced financed sales barely moved. For example, homes priced above $1 million climbed from roughly 1,500 sales in 2020 to more than 3,000 in 2024. Meanwhile, financed sales under $300,000 stayed in a tight range of about 1,200–1,300 per year. The upper arm of the K shot up, while the lower arm remained relatively flat.

In 2025, that gap is finally narrowing. Luxury sales are slowing, and lower-priced sales are rising, creating a more balanced picture than we’ve seen in recent years

So far this year, luxury activity has pulled back:

About 2,300 sales above $1M year-to-date

On pace for around 2,600 by year-end

Roughly 15% fewer than 2024

At the same time, the lower end of the market is gaining momentum:

1,196 financed sales under $300K in 2023

1,302 in 2024

1,504 year-to-date in 2025

This shift indicates that Tampa Bay’s sharp K-shape—luxury booming while the lower tier lagged—is beginning to soften. The market is moving toward something more “normal,” though still uneven.

Even within luxury, performance varies greatly:

$2–3M: down about 42%

$7–9M: down about 55%

$5–7M: the strongest segment, with 48 sales so far this year, more than any prior year.

About 6 months of supply, the tightest among luxury price bands

Some luxury brackets are clearly slowing, while the 5-7M range remains highly competitive.

Affordability is still a major pressure point. The median home price sits around $425,000, which typically requires an income near $100,000 to purchase comfortably. Yet the median household income in Tampa Bay is only $70,000–$75,000.

That means many households can realistically afford closer to $300,000—not the median price. This gap explains why:

Sub-$300K financed sales matter so much

Buyers increasingly rely on tools like rate buy-downs, down payment assistance, and more flexible loan structures

There’s growing speculation that New York City’s new mayor, Zohran Mamdani, could push more high-income residents toward Florida. Locally, many expect this to re-energize Tampa Bay’s luxury market.

We’re already seeing notable activity, including a $19 million Palma Ceia estate going under contract in just seven days. Trophy properties tend to move no matter what the broader luxury market is doing. We inquired with the listing agent to find out if this buyer came from New York, but we have yet to receive a response.

However, most analysts predict any migration boost will be real but modest. The true effect—positive or not—will likely become visible over the next 6–18 months, the typical lag time for economic shifts to show up in real estate data.

Inventory remains tight both nationally and locally. Nearly 1,000 single-family homes were pulled from the Tampa Bay market in October, and closer to 1,700 when condos and townhomes are included. Inventory is roughly 14% below the local peak in May.

Many buyers are waiting for the next Fed rate cut, but mortgage rates don’t always drop after Fed announcements. Some of the best opportunities—seller concessions, reduced competition, and rate buy-downs—are available now, not later.

And if you’re renting, remember:

A $2,000/month rent = $24,000 per year paid toward someone else’s equity

You’re paying a mortgage either way; it just may not be yours yet

You don’t have to wait for spring. Many homeowners plan to list in March or April, which usually leads to a surge in new inventory. Listing before that rush gives you a competitive advantage and a better chance to stand out.

Today’s buyers are more payment-sensitive than price-sensitive, which means:

Rate buy-downs

Seller-paid points

Strategic concessions

…often have a bigger impact than traditional price reductions and can help you attract strong offers without sacrificing your bottom line.

A 50-year mortgage can reduce your monthly payment, which might make a home feel more affordable upfront. But the trade-off is significant: you pay far more in total interest and build equity much more slowly. For most buyers—especially first-time homebuyers—a traditional 30-year mortgage paired with a rate buy-down or a well-structured ARM offers a healthier long-term balance of affordability and equity growth.

Not necessarily. Mortgage rates are influenced more by the 10-year Treasury yield and investor sentiment than by the Fed funds rate itself. In fact, we’ve already seen multiple moments this year where mortgage rates increased immediately after a Fed rate cut. If you can negotiate seller concessions or secure a rate buy-down, buying before everyone else jumps back into the market can often be the better financial move.

Buyers have several tools available that don’t require stretching their loan over five decades. Options include:

Rate buy-downs, whether paid by the buyer or negotiated from the seller

Choosing a 5/1 ARM, if your time in the home aligns with the fixed-rate period

Increasing your down payment, even slightly

Shopping multiple lenders for better rates and lower fees

A trusted local lender can run these scenarios side-by-side—similar to the John and Jane example—to show which approach best fits your budget and goals.

There’s no data suggesting a crash. What we’re seeing is more of a normalization. Luxury sales volume is down from 2024, and some price bands—like $2–3 million and $7–9 million—have slowed sharply. But others, particularly the $5–7 million range, remain strong and continue to show tight inventory. Individual home performance still depends heavily on location, condition, price, and how well the property is marketed.

It depends on your finances and timing, but one thing is always true:

You’re paying a mortgage—either your landlord’s or your own.

If rents are high and stable, buying can be a powerful path to building long-term wealth. With tools like seller concessions and rate buy-downs, many renters are closer to homeownership than they think. A conversation with a local lender and a knowledgeable Realtor is the best way to see what’s possible for your specific situation.

If you’re planning to buy or sell in Tampa Bay in the next 12 months, The Tenpenny Collection can help you build a customized plan based on your income, risk comfort, and goals—not national headlines.

We’ll help you:

Understand your financing options (30-year, ARM, buy-downs, etc.)

Interpret current market trends in your price range

Create a step-by-step strategy to protect—and grow—your equity