Stop looking for your dream home in this market because you aren’t going to find it! Prices are high, interest rates are high, and inventory… well, frankly, it stinks! But none of these things mean you shouldn’t buy a home. Instead of looking for your dream home, which probably doesn’t exist and is too expensive, start thinking about your next home purchase as an investment strategy to build your wealth.

In this article, I am going to give you 3 simple steps to buy a great home, turn it into an amazing home, and all of this with a tax-free payday at the end!

Sound too good to be true? Keep reading…

Let’s start with what not to do when buying a home as an investment. Most importantly, you don’t want to buy the most expensive home on the street. If the home is already the most expensive, it leaves little room for you to create a gain.

The three L’s of real estate are Location, Location, Location and they are essential to this decision.

The top 3 locations are established neighborhoods, trending neighborhoods, and up-and-coming neighborhoods. I’m partial to the trending neighborhoods, as they offer great investments with a little more investment security. Let me explain the differences.

Established neighborhoods are your traditional hotspots within a community. Typically these neighborhoods are characterized by well-established homes, great curb appeal, mature landscaping, sidewalks, and the best schools. The sense of prestige and exclusivity of these areas command the highest property prices as well. More than likely, you will find your dream home here.

Trending and Up-and-Coming are often used interchangeably, but there is a big difference. Trending neighborhoods denote areas experiencing a notable surge in popularity (trending up). Like established neighborhoods, these areas can be identified by the sense of pride in the area. In these areas, you will notice some homes in disrepair but the number of homes being renovated dominates the streets. You’ll also see neighbors engaged in beautification projects, competing for “yard of the month” awards, and establishing neighborhood events like block parties, community garage sales, etc. These areas can often be found within walking distance of new trendy restaurants, coffee shops, and other culturally active areas.

In contrast to trending neighborhoods, up-and-coming areas are still in a state of transition and uncertainty. These neighborhoods are positioned on the brink of becoming sought-after locales but may face economic challenges that hinder their progress. Signs of an up-and-coming neighborhood include a higher prevalence of homes in disrepair compared to those undergoing renovation. While these areas hold promise for future growth and development, they are extremely susceptible to fluctuations in economic conditions. Skilled investors may identify up-and-coming neighborhoods as potential opportunities for long-term appreciation, but they entail a greater degree of risk due to their evolving nature.

Not only do you want to avoid the most expensive home on the street, but you also don’t want to buy the nicest one on the block. If the home is already in perfect condition, it leaves little room for you to create a gain (sweat equity).

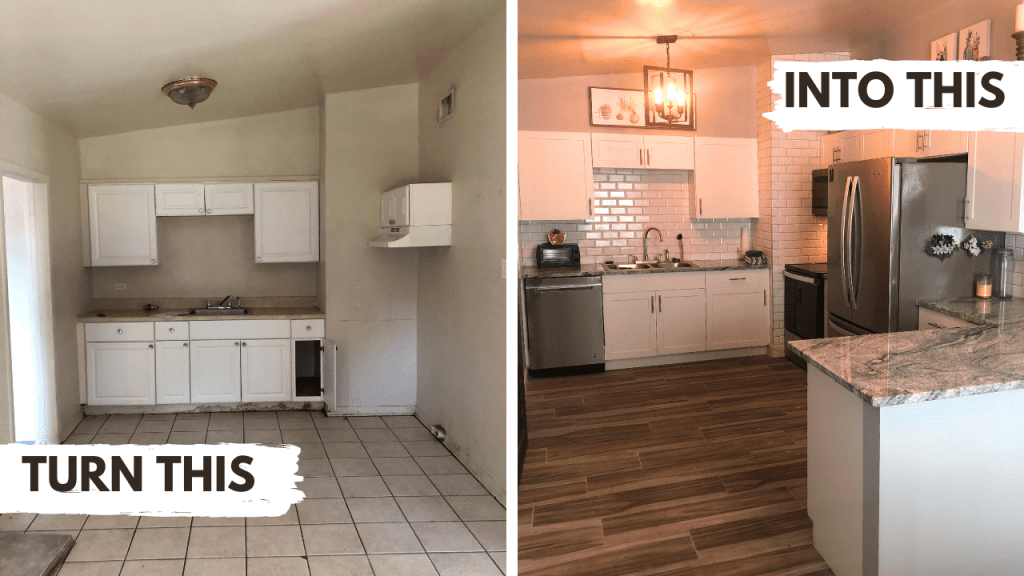

The “Before and After” pictured below is an investment home I purchased and remodeled using the concept of sweat equity. I purchased the property for $130,000 in 2017 in an “Up and Coming” neighborhood. It was worth the risk because the price was right. The remodeling project cost $70,000 and it is now worth $425,000, plus it has provided positive monthly cash flow for years. This investment property is what I consider a win-win. With a Buy & Hold strategy, the property appreciates over time, tenants pay the expenses, and it is a depreciating asset for tax purposes.

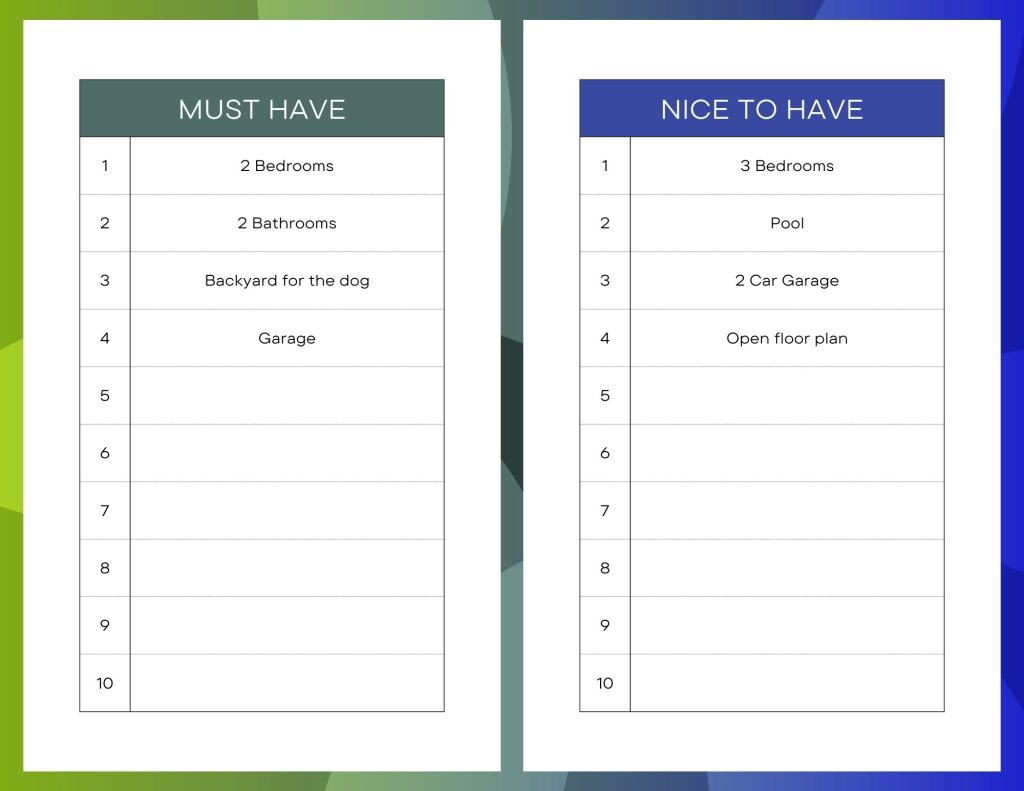

Next, you will want to determine what you must have versus what would be nice to have. The number of bedrooms and bathrooms are typically the top two criteria. You will also want to consider things like size (square footage), garage, yard, pool, and a slew of others. Create a list of “Must Haves” versus “Nice to Have” like the one below.

For example, it would be nice to have a guest room. However, you work from home so you must have a home office. Try to keep your list short. There shouldn’t be more than 5 “Must Haves” on the list. Remember, this is an investment strategy, not a dream home.

Now that you’ve made your list of “Must Have” list, I bet the type of flooring, kitchen finishes, nor wall color made the list. This is how you get to add equity! Cosmetic changes and simple upgrades are the easiest way to add value to your home.

The home you buy as an investment to build your wealth isn’t going to be pretty! The flooring will be mismatched, the countertops are going to be dated, the walls will be dingy, and the yard will be unattractive. However, if the home comes equipped with all of your “Must Haves” and is in the right location – BINGO! You found a winner!

For tips on what home improvement projects are necessary to sell your home down the road, visit my article, “Mandatory Repairs when Selling Your Home.”

Here in lies the best wealth-building secret, HOLD. It is not sexy and it is not a get-rich-quick scheme. However, buying and holding real estate is a tried and true strategy for building wealth.

Not only will you have the luxury of appreciation, but you will also receive the best tax benefit of all, capital gains exemption! Per the IRS tax code, “If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint return with your spouse.”

Your hold time to create maximum gain will vary depending on the amount of equity you add to the home and market conditions. The IRS will require you to live in and use the home as a primary residence for a minimum of 2 years within a 5-year period. (Read more here).

It is also important to know that historic real estate appreciation in the US varies by area but averages out to be 3-4% per year. According to the National Association of Realtors, homeowners stay in their homes for an average of 10 years. This is up from pre-pandemic times of 5-7 years.

New construction is very appealing! Like the scent of a new car, a new home creates an emotion in us that we can’t deny! If you are looking to purchase new construction the number one tip is to buy early!

You don’t have to give up your dream home dreams. The strategy above repeated a few times will put you on your path to buy or build your dream home. You can also remodel your investment property to become your dream home. There is a lot of value in sweat equity and passion. You may surprise yourself and fall in love with the house you turned into a home!

If you want to make a smart purchase in the Tampa Bay area, contact The Tenpenny Collection for guidance. We have tried-and-true resources to help you with your home remodeling needs. This isn’t something you have to figure out on your own. We’ve been helping buyers build wealth through real estate since 2003 and would love to help you on your journey!