Tampa Bay’s real estate market is facing new challenges in the wake of two powerful hurricanes. Flooded homes have been gutted, and debris still lines the streets in many neighborhoods, creating a lasting visual impact on our community. As we assess the damage and rebuilding begins, we’re taking a closer look at how these storms are affecting home values across the Tampa Bay area. This month, we examine the trends in post-hurricane property values and compare them to the August market as our “pre-storm baseline.”

Current Market Inventory: As of early November, there were 255 waterfront homes on the market in Pinellas County (excluding lakes, ponds, and rivers).

October Sales: In October, 37 waterfront homes sold with an average price of $1.8 million—down from 65 homes in August, with an average price of $2.3 million.

Pending Sales: Currently, 88 waterfront properties are under contract, with an average price of $1.4 million.

New Construction Holding Value: Homes built since 2020, with a minimum elevation of 11 feet, remain highly valued. Currently, 28 newly constructed waterfront homes are listed with an average price of $4.8 million.

The storms have led many waterfront properties to sell primarily for land value, while new construction prices are holding strong due to higher base elevations and hurricane-based construction standards. However, affluent buyers may take time to return, as none of the pending or recently sold homes were new construction. An interesting exception is the recent sale of a historic estate built in 1935 in Pass-a-Grille Beach, which sold for $8 million—a testament to the enduring allure of unique waterfront properties.

October Sales: There were 13 waterfront sales in October with an average price of nearly $2.3 million, including three new construction sales averaging $5.9 million.

Pending Sales: As of early November, 25 waterfront homes are pending sale, with an average price of $1.4 million.

While both counties show a shift in buyer preferences post-storms, Hillsborough County’s new construction sales highlight that elevated properties with enhanced storm protections remain desirable.

The hurricanes have increased buyer interest in non-flood zones, especially for those looking to avoid the mandatory flood insurance required in Flood Zones A and AE. In contrast, Flood Zone X, where flood insurance is not required, offers both cost savings and peace of mind.

As storms become a more prominent consideration for buyers, we’re seeing heightened interest in high-and-dry areas. This demand may drive temporary increases in the value of non-flood zone properties, particularly as buyers shift focus from the immediate post-storm cleanup in flood-prone areas.

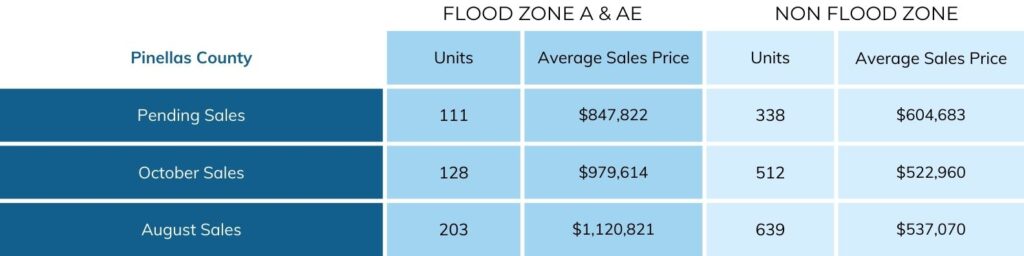

The impact on the number of homes sold in October is across the board. There were 32% fewer homes sold in October versus August. Below we will break down each county and look at home sales in flood zones versus non-flood zones.

Price Impact: The average sales price of homes in Flood Zones A & AE dropped 14% from $1,120,821 in August to $979,614 in October.

The average price of homes in non-flood zones dropped in October as well. However, the pending price shows a strong recovery.

Sales Volume: The number of homes sold in a flood zone decreased by 62% over this period. This indicates not only a reduction in buyer activity, which is to be expected, but the number of homes on the market was drastically reduced. We will touch on this point further down.

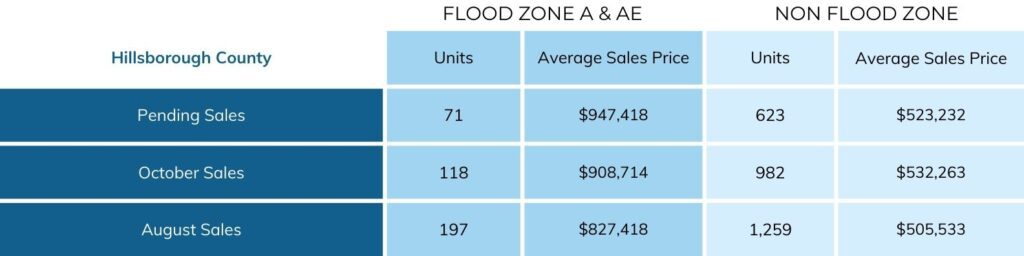

Price Impact: Interestingly enough, the average home price in a flood zone actually increased in October compared to August. This could be an “inland impact”. The further you get away from the coast, the less impact from the hurricanes – figuratively and literally.

Sales Volume: There was a 41% decrease in the number of homes sold in a flood zone and a decrease of 22% in non-flood zones.

In Pinellas County, 991 homes were removed from the market between September 25 and October 31. Some of these properties have since been relisted. The active inventory of single-family homes dropped from 3,164 in August to 2,656 as of mid-November.

Below are the past 3 months overall single-family home sales and average sales prices:

Hillsborough County saw a similar decline with 880 single-family homes removed from the market during the same time period. The active inventory in Hillsborough is currently 3921 homes for sale, down from 4307 at the end of August.

With debris still present in many neighborhoods, the current market environment may not appeal to traditional buyers, and many sellers have opted to wait for spring to relist their homes.

In the coming years, we anticipate a trend of rebuilding with resilience. Many older, single-story homes built in the 1950s–1970s may give way to modern, elevated homes with robust storm protections. This shift could enhance property values for newer, safer constructions, though rising construction and labor costs may limit access to waterfront living for many buyers.

For non-waterfront and non-flood zone areas, there may be an uptick in interest and prices as buyers prioritize safety and cost savings. While the current market reflects caution, we expect Tampa Bay’s enduring appeal and community resilience to drive long-term recovery.

We’ve had our share of challenges this year, with multiple hurricanes testing our strength. This season, we’re taking a moment to reflect on what we are truly grateful for. We’re especially inspired by the resilience of our community, the kindness shown by neighbors, and the unwavering support from friends and family. It’s in times like these that we remember just how strong and connected we are.

If you have questions about your property, we have answers and resources for you. You can read information about FEMA and the 50% Rule hereFEMA, Market Trends & St. Pete Updates.

Thank you for being part of our journey and for making a difference when it mattered most. Here’s to brighter days ahead and the blessings of this season.