This month our Tampa Bay real estate market update is full of Rules of Thumb, Myths, Wives Tales to help you make smart real estate decisions in a shifting market.

After serving the Tampa Bay real estate market for over 2 decades and growing up in a real estate family, I’ve heard it all when it comes to rules of thumb, myths, and wives tales. Hopefully, this information will help guide you through the confusing data, trends, and conditions of our local real estate market so you can make smart decisions when buying or selling a home.

Let’s start with the numbers and see how they apply to your home buying and selling needs.

There are 3 types of real estate markets – rising, declining, and flat (or steady). Knowing the type of market when purchasing or selling a home is important to determine your specific strategy. This month we will identify the type of market the Tampa Bay area is experiencing and the strategies to help you succeed. Let’s get started with a rule of thumb…

“A rising tide lifts all boats“ or in other words – In a rising market, it is easy for your home to gain appreciation. You don’t have to do anything and you make money. We saw this during the pandemic years with property values nearly doubling in some areas.

However, my favorite saying about rising tides is from Warren Buffet who said, “Only when the tide goes out do you discover who’s been swimming naked.” Essentially he is saying – even a fool can make money in a rising market.

A declining market might sound scary but it is where opportunities are abundant. Prices come down, and sellers get nervous and want to pull the plug to cut their losses – this creates opportunities for savvy buyers.

In a flat market, you have to look for strategic ways to grow your return. You can not rely on appreciation and there is a risk that the market could decline. The old rule of thumb is to expect a 2-3% year-over-year appreciation in this type of market.

Right now, there are just over 3,300 homes for sale in Pinellas County, this is up 42% compared to last year. And the average list price is $905,000!

Hillsborough County is larger so the inventory is slightly higher, with about 4,100 homes for sale, up 35% compared to last year. The average list price of $553k.

The average price in Pinellas is a BIG NUMBER and a surge of luxury listings is pulling it up. Currently, 20% of the active inventory in Pinellas is priced above $1m.

However, the median sales price has remained flat for more than a year in the Tampa – St. Petersburg – Clearwater area. The median price in February was $455,000 in Pinellas. In February of 2024, the median price was $452,000. In Hillsborough County, the median price in February was $420,000. Last year it was $424,475.

Just as a reminder – The median price is a better metric for determining the overall health of a market because it is less susceptible to being skewed by extremely high and low values.

Okay, we are in a flat real estate market. How can strategically grow your return on investment and make smart real estate choices?

“You make money when you buy a home, not when you sell”, meaning your purchase price is the most crucial factor in determining your future profit or loss. Location, market trends, and property conditions must come into the equation.

You will also want to ask the following questions:

We will provide more tips for buying a home or selling a home further down in the article. But first, let’s bust a common misconception of Florida’s seasonal sales cycle.

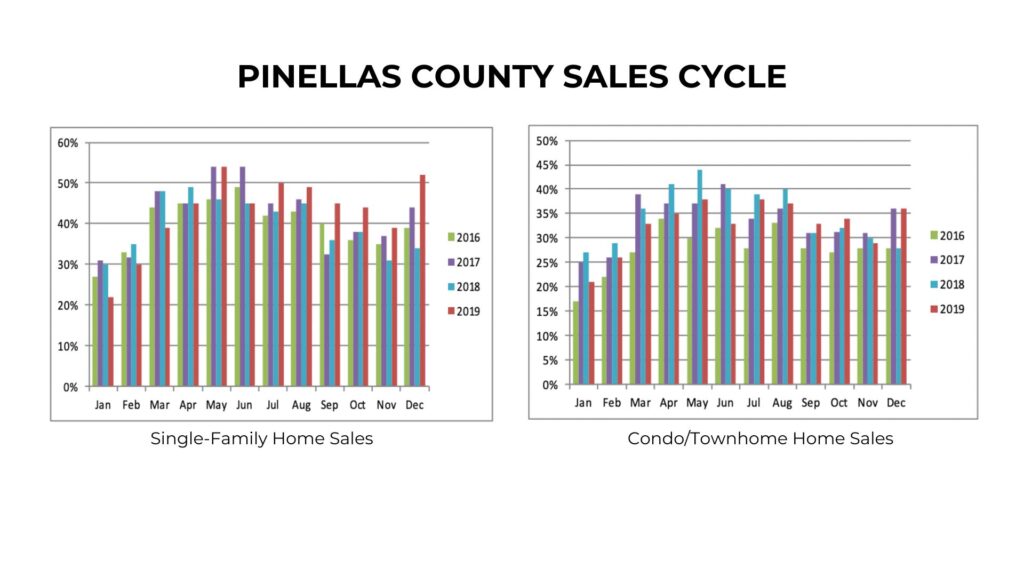

A lot of people assume Florida’s busiest season is in the winter when snowbirds are here, but that’s not the case. Just like everywhere else, our peak season is May through August, and it is driven by the school year. This is the major force impacting the national housing move over the summer months and it holds true even here in Florida when it is hot, humid, and hurricane season has started.

Our sales season is just warming up and the proof is in the numbers. In February, home sales jumped nearly 30% compared to January, which is totally normal for this time of year. The image below shows the pre-pandemic sales cycle in Pinellas County for single-family homes and condos/townhomes. We used pre-pandemic because the sales cycle was skewed during the pandemic buying frenzy. It has returned to normal.

Expect the inventory and number of sales to continue to grow over the next few months and start to slow down at the end of August – early September.

However, don’t confuse the increase in activity to translate to an increase in value, home prices are holding steady. You can also expect homes to take longer to sell in this market.

For this wive’s tale, let’s look specifically at the luxury market. As discussed above, the average price in Pinellas jumped to 905K due to a surge in luxury listings. This segment of the market has shifted to a Buyer’s market with an 8-9 month supply of inventory.

For a point of reference, a 6 month supply is considered a healthy balanced market. Homes priced between $1-1.5m are in a balanced market with a 6-month supply of inventory. All other high-end home sellers need to be prepared for an extended time before going under contract.

Luxury homes are sitting on the market for 74 days on average before going under contract. In a buyer’s market, longer days on the market don’t translate to a problem with the property – this is a wives’ tale.

So what does it mean if a property has been sitting on the market for a long time? In a buyer’s market, you can expect homes to take longer to sell because buyer demand isn’t there. This can also be determined by looking at the absorption rate.

The absorption rate shows the number of homes absorbed out of the market. It’s calculated by dividing the number of closed sales by the number of active listings.

In February, the Tampa Bay absorption rate was around 25% (1845 sold homes divided by 7501 active listings). Or in generic terms only 25 homes sold for every 100 listed for sale.

Compare this to the pandemic peak in March 2022 of 244%. That was a strong seller’s market because buyer demand was unprecedented!

The simple answer is mortgage rates.

The more complex answer is affordability. Overall costs such as property values, rates, insurance, and taxes have all increased over the past few years putting homeownership out of reach for many.

Buyers who wish to upsize or downsize are also considered locked-in their homes with mortgage rates 4% or lower.

Try to shake off the herd mentality. If you can buy – BUY! You finally have options with more properties available for sale AND you have negotiation power.

Be strategic: Look for properties that have been on longer than average. These properties usually have improvements needed that will add value. More importantly, the seller is going to be more eager to negotiate!

Interest rates: Are mortgage rates holding you back? Good news! They have dropped from their high of 7.16 in January down to 6.75 in early March. Keep in mind, these are national averages and you may be able to qualify for a much better rate depending on your credit score. If the slight drop in rates isn’t enough, consider asking concessions from the seller for a rate buy-down. Want to know more about this option? Reach out and we will connect you with a trusted mortgage partner to give you all of the details.

Good news! It is the season! As we discussed earlier, our market is heating up for the hot summer sales season.

With so much competition, especially in the luxury market, it is more important than ever to get your home ready for the market.

Price it right and make sure your home is positioned to shine. Buyers have choices, so your home needs to stand out above the rest. They want cosmetically pleasing homes and all of the mechanical upgrades have been completed. Review our article from last month about 4-point inspections to help you understand which mechanical upgrades are critical.

Know your elevation. This is now one of the first questions buyers ask: “What is the home’s elevation?”

If you are in a flood zone and don’t have an elevation certificate, get one before going on the market. You can order one through a survey company—if you need a recommendation, let us know.

If you want to know how all of this information relates to your specific real estate needs, we are here to help! Each home, each neighborhood, and every situation is different. We can guide you to make the best decision for your real estate journey. Our goal is to provide the knowledge and service you deserve! Reach out today to get started!