One year ago, Tampa Bay held its breath as Hurricanes Helene and Milton tore through our coast. On September 27th, 2024, I stepped outside to find devastation everywhere — debris, flooded cars, flooded homes, no cell service, no gas at the stations, no electricity.

Over the next few weeks, I walked the streets helping more than 30 homeowners remove the ruined contents of their homes. Rugs, couches, clothes, drywall, cabinets, and flooring were amassed in massive debris piles and lined every street.

Today, those same streets are filled with new construction, restored homes, and a sense of pride in our community’s recovery.

But if you’ve been watching the national headlines, you might think Tampa Bay’s housing market is in trouble. Let’s set the record straight — it’s not.

Tampa Bay’s real estate market is resilient, and the data will prove it.

Watching national real estate headlines to gauge your home’s value is like checking the national weather to decide if it’s a good day for the beach.

Real estate, like the weather, is hyperlocal.

That’s why we produce the Tampa Bay Market Update every month —

to give you the information that truly impacts your home equity and real estate strategy.

This month we are going to focus on 4 main items:

Believe it or not, Tampa Bay is still in a seller’s market, with around four months of supply — nearly unchanged for the past year.

As a reminder, a seller’s market happens when the market has less than 6 months’ supply of inventory. A 4-month supply of inventory suggests that if no other listings come on the market, it would take 4 months to sell the current selection of homes.

A balanced market is a 6-month supply of inventory.

A buyer’s market is more than 6 months’ supply.

Typically, in a seller’s market, it means it is easier to sell your home. That isn’t what we are seeing for many sellers because only 25% of active inventory is selling each month.

It appears buyers are waiting for a buyer’s market, and sellers are refusing to see it happen. Instead of putting their homes on the market, sellers are waiting for conditions to improve.

In September, over 1000 homes came off the market – these listings expired or were cancelled

The continued delisting trend has caused inventory for single-family homes to drop 13% as compared to the hot months of the summer.

It appears property owner and Buyers are both waiting for conditions to improve. Who do you think is going to win the “wait and see game”?

💭 Buyer Question: “Is Tampa Bay a buyer’s market yet?”

Not yet — but buyers have more leverage now than they’ve had in years. Inventory is rising, and motivated sellers are listening, but it is still a seller’s market with only 4 months of inventory.

💭 Seller Question: “Should I list now or wait?”

There is rarely, if ever, a “right moment” in the real estate market. Fewer homes go on the market in the last months of the year, which means you have very little competition. Strategic pricing and strong presentation can position your home ahead of the curve.

The “Frozen Housing Market” continues with a lack of sales activity. Why is the housing market frozen? Here are the top 4 reasons:

In Pinellas County, 812 homes sold in September, which is up 22% year-over-year. However, it is down 29% compared to September 2019.

Hillsborough County recorded 1,214 home sales, up 14% compared to last year. Home sales are down 34% compared to the 2019 transaction count.

💭 Buyer Question: Are homes actually selling right now?

Yes! Well-priced homes in move-in condition are still moving quickly. Well-positioned homes are still seeing multiple offers.

💭 Seller Question: If homes are selling, why are some listings sitting so long?

Homes that linger usually have one of three issues: price, condition, or presentation. Fixing one (or all) of these changes everything. We dive into this in our Guide: Selling Your Home in a Slow Market.

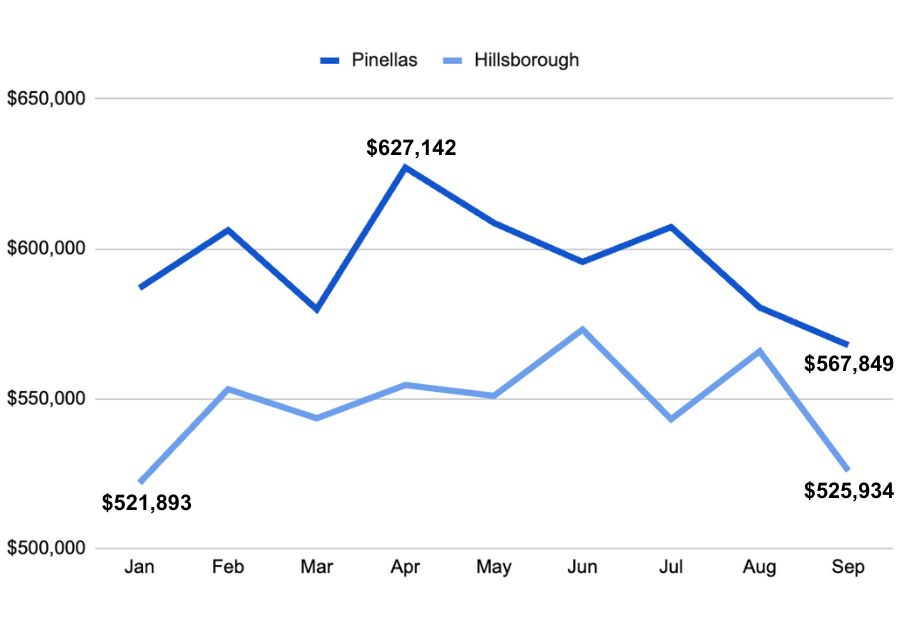

Last month, we reported that the average sales price jumped 5.4% YOY in Tampa, but September numbers were not so good. The average sales price was down to $529,934, competing with the January $521,893 average for the lowest price of the year.

Because month-to-month average sales prices tend to be a roller coaster, the median price gives us a better sense of the market conditions. Median prices dipped slightly from $430K to $428,700, but no indicators show a market crash.

Pinellas County saw the lowest average sales price of the year at $567,849. January was 586,949. September’s average sales price was $60,000 below April’s peak!

💭 Top Buyer Question: Should I wait to buy?

Waiting rarely helps.

Home prices are stabilizing, and mortgage rates around 6.2%–6.3% are favorable. Fall and winter months tend to have the best deals for buyers, as shown in the data above.

Do not expect prices to continue to decline. When rates dip into the high 5s in the early spring, expect demand and prices to increase.

💭 Seller Question: How should I price my home in this market?

Price to attract, not to test. Use data-driven comps, factor in buyer psychology, and pair that with a strong presentation. Smart pricing sells faster than wishful pricing. Pricing, condition, and presentation are detailed in our Guide: Selling Your Home in a Slow Market

Florida’s housing market is in a state of transition. Many national reports show YOY declining numbers, but those reports don’t reflect the true local story here in Tampa Bay.

Why? Because they rely on Zillow’s Home Index Value, which shows 12-month rolling data. In Tampa Bay, we are just now closing the first full year since Hurricanes Helene and Milton reshaped our region.

Until we reach the end of that 12-month cycle (end of October), the year-over-year comparisons will still show negative numbers. But here’s the good news: behind those headlines, the real data is already signaling strength.

Let’s look at one of the hardest-hit areas, Pinellas County, comparing October 1–15, 2024, to the same period in 2025:

That’s a 13% increase in average sales price and a 79% increase in transaction volume.

Those aren’t numbers of a struggling market — they’re the signs of a community in recovery and growth.

Over the next few months, national analysts may continue to report soft numbers.

That’s simply because their data doesn’t yet include the post-recovery period. October’s data will not be released until late November, and the media will not receive it until early December.

In short, expect the headlines to lag behind reality.

By the time they catch up, Tampa Bay will already be moving forward.

October and November sales numbers are historically slower. December’s numbers tend to spike as buyers want to close before the end of the year. Then, as we move into early 2026, the combination of lower mortgage rates, positive YOY gains, and pent-up demand will bring new energy back into the marketplace.

💭 Buyer Question: Will home prices rise again soon?

Yes — as early as spring. Once mortgage rates dip slightly, buyers who’ve been sitting on the sidelines will re-enter the market. That renewed demand will tighten inventory and strengthen prices.

💭 Seller Question: Should I list now or wait until the market rebounds?

It depends. If your home is ready, list now. If you are selling an investment property, now is the best time, as investors want to close out the tax year. Residential inventory is lower heading into winter, meaning less competition. By the time spring arrives and everyone else lists, you’ll already be under contract.

What we’re seeing isn’t just economic — it’s emotional.

The last few years have left many buyers and sellers mentally exhausted. Between rising interest rates, shifting headlines, and post-storm uncertainty, people simply needed a breather.

But real estate isn’t static. Those who “paused” are still out there — and when they’re ready, the energy will return fast.

I believe we’re looking at nearly three years of pent-up buyer demand waiting to resurface. And when it does, it will catch national analysts off guard.

💭 Buyer Question: What happens if I wait until next year to buy?

You may face higher competition and fewer negotiable sellers. Acting now could mean locking in equity before prices climb again.

💭 Seller Question: If buyers are coming back, should I raise my price?

No. Keep your price strategic, not speculative. The best way to maximize your sale is to capture early demand, rather than chasing the top of the market.

Tampa Bay has weathered literal storms. The sales numbers over the upcoming months will show positive gains in the housing market.

Buyers have sat on the sidelines for nearly 3 years. Affordability is coming back into reach for many due to flat home values, insurance reform, and lower mortgage rates.

In my professional view, we’re entering a sensitive market that can easily tilt one way or the other. Buyers will continue to be skeptical of the market conditions. Sellers must be patient, price properly, and prepare their properties according to what buyers want. Don’t expect drastic changes. Slow and steady wins the race!

👉 Subscribe to our YouTube Channel for monthly market updates and visit The Tenpenny Collection for expert insights, luxury listings, and local real estate guidance.