If you’ve been following the headlines, you’ve probably seen the words “Tampa housing market crash” making national news. But the story is more nuanced.

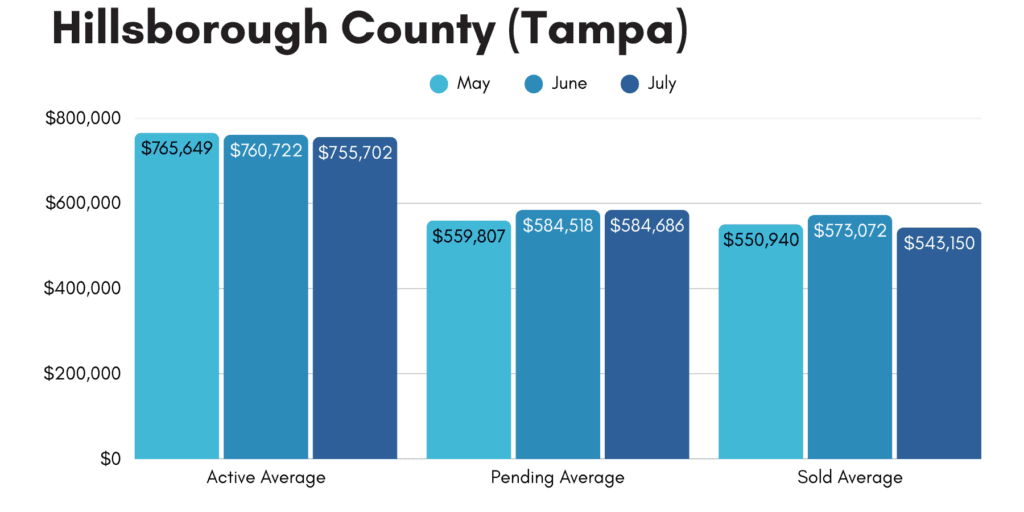

Tampa/Hillsborough County has remained steady, or flat. Home prices in July were the same as they were in July of last year.

That looks stable. But national analysts aren’t looking only at Tampa—they’re looking at the entire Tampa Bay region, which includes Pinellas, Pasco, and Hernando Counties.

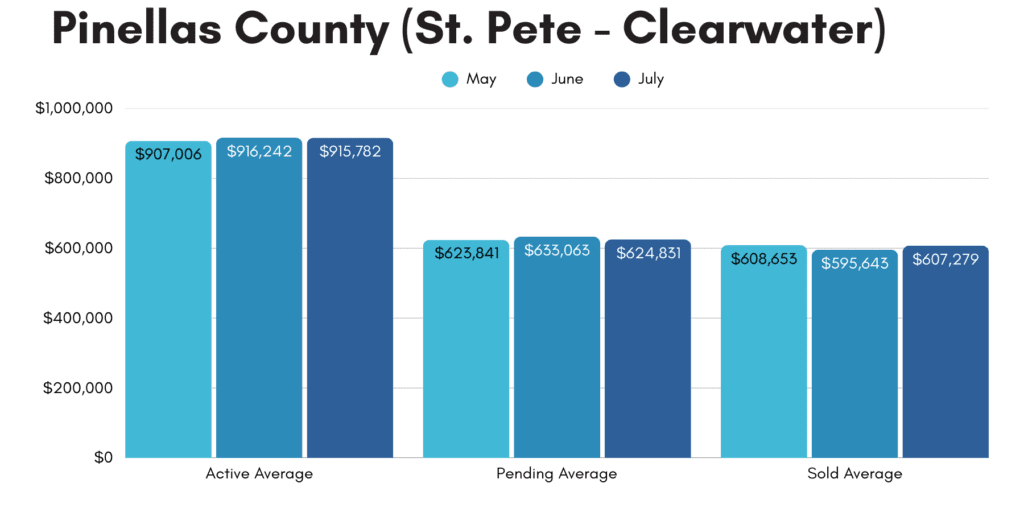

So why is Pinellas County dragging down the numbers?

Those of us who live here know what happened – Hurricane Helene (9/26/2024) and Hurricane Milton (10/9/2024). Even though the double whammy storms hit 10 months ago, their damage is ongoing.

Some of the hard-hit areas were St. Pete Beach, Treasure Island, and Northeast St. Petersburg. In these areas, the average sales price was down 30% in July compared to the previous year!

Here’s why:

Despite this, 3,452 homes sold in Tampa Bay in July—just 100 fewer than the year before. So while some areas are struggling, the market overall is still active.

Some sellers are waiting to list until after hurricane season, hoping a quiet season will stabilize values. Buyers, meanwhile, are watching to see if major storms remain “once-in-a-century” events or if they’re becoming annual occurrences.

This hesitation is adding fuel to a national “de-listing surge.” In July, more than 1,000 homes were taken off the market in Hillsborough and Pinellas—a 30% increase compared to last year.

Compared to other regions, yes.

The National Association of Realtors reported that in June 2025, the median price of an existing home in the Northeast was $543,300. Tampa Bay’s median of $430,000 is about 20% lower.

The Tampa Bay real estate market isn’t crashing, but it is cooling off from the explosive growth from 2020 – 2023. During this time, the housing market got too hot, too expensive, too quickly. Home prices soared, but so did insurance, property taxes, and mortgage rates, causing affordability to become out of reach for many.

There’s good news here. After years of dramatic increases, Florida’s insurance market is showing signs of relief:

Reforms targeting fraud and frivolous lawsuits are credited with helping stabilize the market and attract new insurers, which could foster more competition—and eventually more savings—for homeowners.

Governor Ron DeSantis has made property taxes a centerpiece of his policy proposals. These include:

But critics warn that doing so could require doubling the sales tax to 12% in order to maintain funding for schools, police, and fire services. Any permanent change would require a constitutional amendment and voter approval.

Mortgage rates remain one of the biggest factors shaping Tampa Bay’s market.

Experts believe demand will rebound if rates dip below 6%.

Here’s how much rates matter:

That difference in monthly payments has kept many buyers cautious, but it also means opportunities for those ready to act.

Is the Tampa Bay housing market crashing?

No. The market is cooling but not crashing. Hillsborough County prices are flat, Pasco and Hernando are down slightly, and Pinellas County has dropped 5.5% due to hurricane impacts and a general slowdown.

Why are prices dropping in Pinellas County?

The lingering effects of Hurricane Helene and Hurricane Milton caused major flood damage in St. Pete Beach, Treasure Island, and Northeast St. Pete. Many storm-damaged homes are selling at land value, dragging down average prices by up to 30% in some areas.

Are Florida insurance premiums going down?

Yes. After years of steep increases, Florida’s insurance market is showing relief in 2025. Citizens Property Insurance announced a 5.6% rate cut, and Florida Peninsula Insurance has requested decreases of 8.4% for homeowners and 12% for condos.

Will DeSantis eliminate property taxes?

Governor Ron DeSantis has proposed $1,000 rebate checks, raising the homestead exemption to $500,000, capping assessment increases, and eventually eliminating property taxes on primary residences. Critics warn this could require doubling the sales tax to 12%.

What are mortgage rates in Tampa Bay right now?

As of July 2025, average mortgage rates are around 6.5%. They peaked near 8% in 2024. Experts predict demand will increase if rates fall below 6%.

Is Tampa Bay still affordable compared to other regions?

Yes. Tampa Bay’s July 2025 median home price was $430,000—about 20% lower than the Northeast U.S. median of $543,300. However, affordability remains stretched by higher insurance, taxes, and mortgage rates.

The Tampa Bay real estate market in July 2025 is best described as cooling, not crashing.

Pinellas County continues to feel the impact of Hurricane Helene, property taxes are a political talking point, insurance is showing rare signs of improvement, and mortgage rates remain the key driver for buyers.

Whether you’re buying, selling, or just watching, the key is understanding these shifts and planning accordingly.

Contact The Tenpenny Collection today for guidance tailored to your situation and neighborhood.