Tariffs, inflation, and interest rates dominated headlines throughout the first half of 2025. Now that financial markets have begun to stabilize, homeowners and investors alike are asking:

What does this mean for the second half of the year?

Has my property value been affected?

Is now the right time to buy?

To forecast the rest of the year, we must first understand where the market currently stands.

Across the US, home prices are up just 0.7% year to date, down significantly from the 4.4% increase in 2024. Florida, once the epicenter of explosive growth, is now leading the national correction. Markets like Punta Gorda, Naples, and Sarasota are experiencing the steepest declines.

May through August historically dominate the real estate cycle in Florida. This summer, however, Tampa Bay tells a tale of two very different markets.

If you’ve been watching the national housing news, you’ve heard that the Tampa metropolitan area is down. Zillow recently reported that Tampa is down 5.4% year over year.

Interestingly enough, Tampa is holding pretty steady; their neighbors across the bridge in St. Pete-Clearwater are dragging down the numbers.

In Tampa, the average sales price is down, but only by about 2.4%.

However, across the bridge, Pinellas County has seen the average home price drop 12.25 year over year.

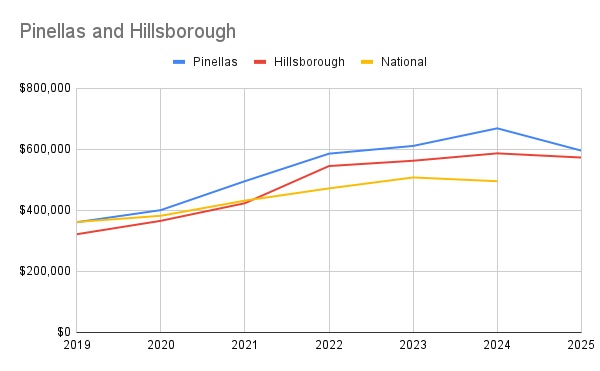

Below is a chart showing the average sales price in Pinellas and Hillsborough Counties versus the national average.

Sales prices are up 10% since January

Inventory has increased 15%

Transactions are up 78%—a sign of market resilience

Average home prices are down 12.25%

Inventory is up 17%, but sales have only risen 31%

Buyer confidence is waning, due in part to lingering storm damage

Nine months after Hurricane Helene, its effects are still visible. Many remediated flood homes are selling for just 60–70% of pre-storm values, often at land value. These discounted sales are pulling down overall averages.

The slow permitting process has compounded the issue. As of mid-2025, many homeowners are still awaiting city approval to rebuild. This backlog has left properties disheveled and abandoned, yards overgrown, and local businesses closed—draining the vibrancy from once-coveted beach neighborhoods.

One recent buyer from out of state described St. Pete Beach as feeling “slummy.” Such perceptions have real consequences for beachfront property values.

In 2019, Pinellas County’s average home price matched the national average of $361K. As of the end of 2024, it was 35% higher than the national average, pricing out many buyers. With high interest rates and high prices, affordability has become a serious obstacle, even for well-qualified buyers.

This leads to an affordability problem. If people can’t afford to buy the homes, they won’t. And we are seeing this happen.

The numbers below show the impact that higher prices and higher interest rates are having on the housing market.

Inventory:

2019 = 3,049 homes

2025 = 3,877 homes

Pending Sales:

2019 = 1,675 homes

2025 = 1,154 homes

Closed Sales:

2019 = 1,178 homes (avg. $361K)

2025 = 930 homes (avg. $595K)

Home sales have remained very low. Not only can buyers not afford today’s home prices, but they also don’t want to buy. Why would they when every major headline tells us the market is crashing?

If interest rates, along with housing prices, put homeownership out of reach for so many, who is left to purchase all of these homes for sale?

Pair this with sellers who are holding strong to their 2022 idea of value. As I stated last month, it is a tug of war.

But let’s put all of this into perspective – there were 930 homes sold in Pinellas County last month. Obviously, there are still people who want to buy a home, and there are sellers who want to sell a home. It is about finding the right balance.

Expect sales to cool off in September through November, following the traditional summer surge. December often sees a bump from buyers aiming to close before year-end for homestead and tax advantages.

A gradual, steady decline in home prices is likely for the rest of the year. Don’t expect a dramatic drop—but the softening trend is not over.

The Fed may lower rates slightly, but a 0.25% reduction is unlikely to shift buyer behavior significantly, especially without accompanying price drops.

Here’s a quick breakdown based on when you bought:

2023–2024: Likely a decrease in value

2022: Expect to break even

2021 or earlier: Some appreciation remains, but reset your expectations. 2022 pricing is no longer realistic

The average time a person stays in their home has increased to 12 years. If you purchased 10-12 years ago, you are in a great position. However, beware of holding onto outdated pricing fantasies. That market is gone.

On every message board about buying a home, there are several comments stating, “waiting for prices to come down”.

If you’re waiting for the market to hit bottom, consider this:

Prices in Pinellas County are already down 12% from last year.

Now the question is – how low will they go?

It makes me think of the game, Limbo – how low can you go?

How low can you go before you fall on your back, lose the game, aka miss the opportunity, before the bar resets at a higher position?

Very few, if any, win at the nearly impossible game of timing the market.

Real estate is a long-term investment. If you plan to own for 10+ years, and you’re buying at today’s market value, not yesterday’s peak, you’re making a strategic move.

Look for:

Motivated sellers

Realistic pricing

Long-term value for your lifestyle

According to Realtor.com, a “delisting surge” is underway. Sellers are opting to remove their home from the market and wait versus negotiate. This is a sign of two things, in my opinion;

Optimism: They believe prices will rebound

Lack of urgency: They don’t need to sell

In Tampa Bay, many are waiting out hurricane season, hoping a calm year will restore confidence and boost values.

But here’s the truth:

We don’t know what this hurricane season will bring.

We don’t know if Helene was a 100-year event or a new annual norm.

This uncertainty has many sellers and buyers sitting on the fence.

Tampa Bay remains one of Florida’s most desirable regions to live, invest, and retire. Despite headwinds, the region benefits from:

Sunshine, coastal lifestyle, and no state income tax

Continued out-of-state demand

Long-term resilience despite short-term fluctuations

No matter the market, there is always a buyer for the right home at the right price—and a seller ready to make a move.

Stay informed. Stay strategic. Stay realistic.

👉 Subscribe to our YouTube channel for timely updates on the Tampa Bay housing market.

👉 Explore available luxury homes for sale in St Petersburg, FL

👉 Connect with The Tenpenny Collection—where luxury is a level of service, not a price point.

Let’s find your place in Tampa Bay.