One of the most common questions I get is, “How’s the real estate market?”

My answer? It’s confused.

From record-high prices during the pandemic to rising interest rates and storm-damaged properties hitting the market, Tampa Bay’s real estate landscape has been unpredictable. But there are clear trends emerging.

In this month’s market update, we’ll break down:

Home Prices – Where prices stand and how they compare year-over-year

Inventory – How rising inventory levels are shifting the market

Buyer Demand – Are buyers jumping back in or sitting on the sidelines?

Storm-Damaged Homes – The impact of flood-damaged properties selling at land value

Plus, I’ll provide helpful strategies if you’re considering buying or selling in the upcoming months.

This is the only newsletter providing real local data and factors impacting our Tampa Bay real estate market.

Active Listings: 3,218 homes available for sale (Avg. list price: $881,032)

Pending Sales: 1,117 homes under contract (Avg. list price at contract: $665,581)

Sold in January: 703 homes closed (Avg. sales price: $586,973)

Year-over-year change: Home prices are down 6.5% compared to January 2024, but sales activity is up 22%—a promising start to 2025.

Active Listings: 4,061 homes available (Avg. list price: $696,498)

Pending Sales: 1,643 homes under contract (Avg. list price at contract: $554,071)

Sold in January: 816 homes closed (Avg. sales price: $522,025)

In Tampa, home prices have remained relatively flat. However, sales volume in January dropped 8% compared to last year.

Key takeaway: Sales are increasing in some areas, but rising inventory is applying downward pressure on prices.

Over the past few years, Tampa Bay experienced an unprecedented surge in home prices.

May 2021: Home prices jumped 27% compared to the previous year.

May 2022: Prices increased another 32%.

With buyers desperate to secure a home, appraisal gap clauses became the norm. Many buyers were willing to pay 10, 20, 50, 100,000, or more above the actual appraised value of a home.

Mortgage rates rose above 5% in May 2022 and buyer activity started to slow. By the second half of the year, interest rates were at 7% and buyer demand plummeted from its pandemic highs.

Fast forward to 2024:

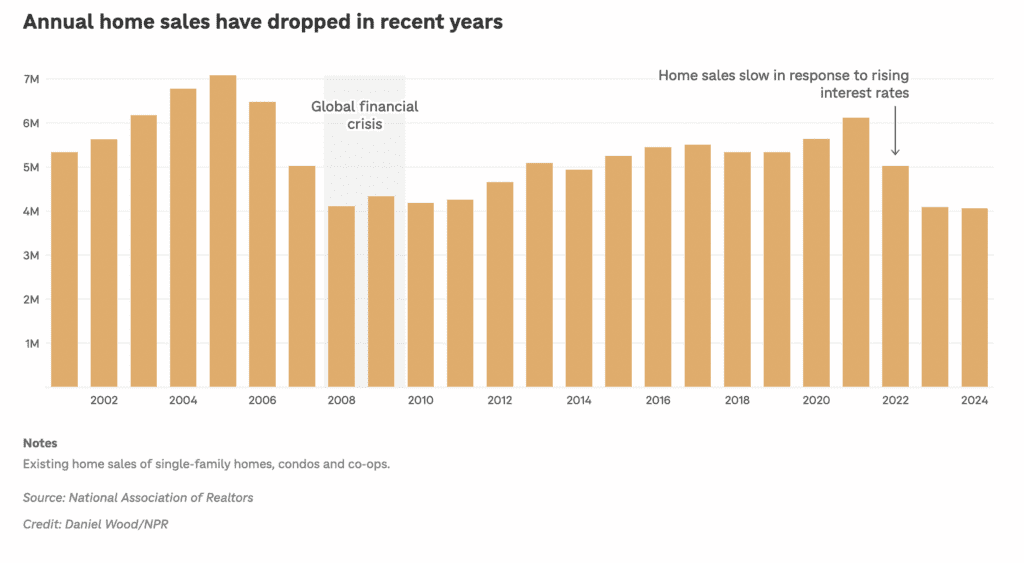

National home sales hit a 30-year low, with only 4.06 million homes sold—the worst since 1995. There were fewer homes sold nationally last year than compared to the Great Recession of 2008-2009!

Buyer demand remains low as interest rates continue to hover around 7%. Nationally, approximately 60% of homeowners are either “locked in” and are “stuck in” 4% interest rates, or lower.

To see the impact of interest rates, let’s look at an example of a $400,000 mortgage.

Inventory is on the rise. In the St. Pete – Clearwater (Pinellas) area active listings increased 33% in 2024 compared to 2023. Tampa (Hillsborough) saw a more modest increase of 26%.

As a result, prices are starting to decline:

Pinellas County: Home prices down 2.7% YOY

Hillsborough County: Home prices down 3.8% YOY

What are Buyers Buying?

With the small number of buyers in the market, it begs the question, what are they buying? The average home sold in January had 3 bedrooms, and 2 bathrooms, and ranged between 1600 – 1700SF, with a price between $500-600,000. More importantly, 70% of all the purchases were in a non-flood zone.

One of the biggest factors affecting our market? Flood-damaged homes.

Pinellas County saw a 22% increase in home sales in January compared to the previous year. We have also seen a 43% increase in cash purchases. Cash is king when it comes to the purchase of flood-damaged homes. This could explain the increase in January’s sales numbers.

In January, waterfront home prices in Pinellas County were down 34% compared to pre-storm levels. Many of these homes are selling at land value—dirt cheap.

Even non-waterfront homes in storm-impacted areas are seeing a surge in inventory. Some of the hardest-hit communities include:

Riviera Bay: 23 homes for sale; 4 sold in January

Shore Acres: 157 homes for sale; 30 sold

Treasure Island: 70 homes for sale; 19 sold

While these lower sale prices present opportunities for investors, they’re also raising concerns about how much further home values could decline. Buyers who dream of remodeling these homes can only do so with cash. Conventional financing is not available on homes in these conditions.

With rising inventory and declining prices in some areas, Tampa Bay could see a more balanced market in 2025.

For buyers:

For sellers:

The Tampa Bay real estate market is shifting, and while prices have softened slightly, rising inventory presents new opportunities for both buyers and sellers. If you’re thinking about making a move, now is the time to strategize—whether that means taking advantage of lower prices, assessing storm-damaged properties, or preparing for the spring market.

Stay ahead of the trends by keeping an eye on local data and expert insights. If you found this update helpful, subscribe to our YouTube channel for more in-depth market reports, home tours, and real estate tips. Let’s navigate this market together!

Contact us for more information if you are buying a home or selling a home in Tampa Bay.