This month’s Tampa Bay real estate market report is full of information impacting our local home sales prices. We will discuss flooded homes, interest rates, affordability, the end of the Great Migration, and now, distressed property sales. Buckle-up! This is going to be a long and bumpy ride.

It has been two and half months since Hurricane Helene flooded homes in Tampa Bay. Most of the debris from the streets has been removed. However, thousands of homes still sit vacant with their interior walls cut out and no cabinets, appliances, or flooring.

According to an article in the Miami Herald, St. Petersburg officials have estimated that 10,000 homes were affected by the flood from Hurricane Helene. The question remains for many property owners – what to do next? And while homeowners weigh their options, the local real estate market is in a state of flux.

With so many homes damaged it was surprising to see more Pinellas home sales in November 2024 (682) compared to November 2023 (674).

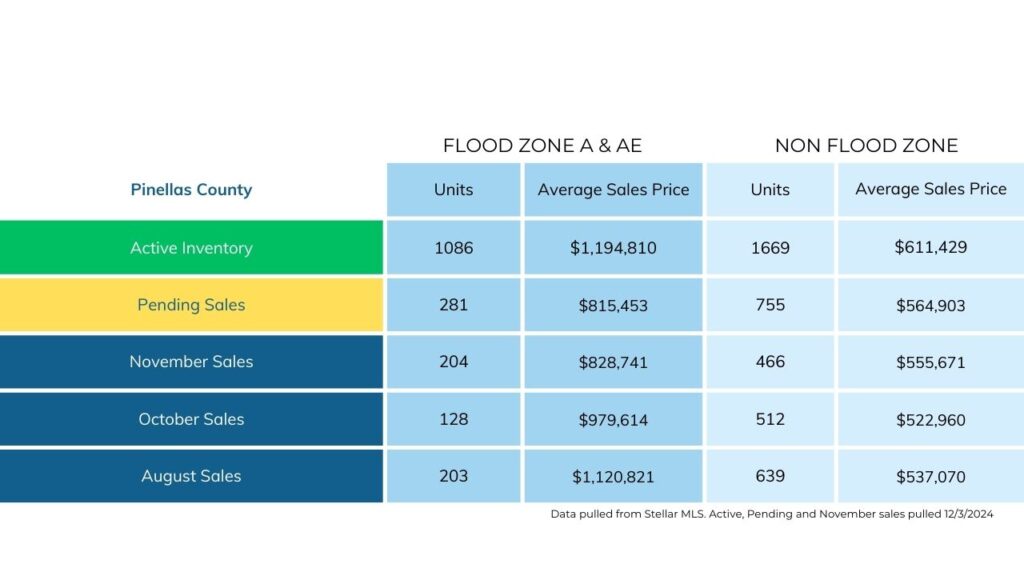

As you can see from the chart below, the price gap between flood zones and non-flood zones is shrinking month by month. This is primarily due to many homes being sold at land value. As time goes on and more homes are renovated or rebuilt, we expect to see the price gap return to normal. The allure of living on the water is still a dominant factor for Florida home buyers.

Hillsborough County, encompassing the Greater Tampa Bay area, reported that only 1,200 properties were impacted by Hurricane Helene. While the storm left its mark, the majority of the market remains resilient. To maintain normalcy in our monthly market insights, we’ve analyzed Hillsborough County sales numbers for November 2024.

Side note: These numbers are not the official numbers. Real estate statistics are typically released 4 weeks after the previous month’s sales have ended. We don’t like to wait that long. This month, we’re providing statistics directly from Stellar MLS rather than waiting for the local Board of Realtors’ official report.

Active Listings:

Pending Contracts

November Single-family Home sales

November is historically one of the quieter months in real estate. The holiday season often results in lower inventory as sellers delay listing their homes until after the New Year, and fewer buyers actively search for properties. Hillsborough County’s housing market continues to demonstrate resilience, even in the face of seasonal and external challenges. As we approach the new year, inventory levels will likely increase, and more buyers will re-enter the market.

Fueled by the rise of remote work and low interest rates, The Great Migration was an enormous social and economic shift across state lines during pandemic years. Florida reaped the benefits with an estimated 562,788 net population growth from July 2020 – July 2022.

High interest rates and surging home prices have put an end to the Great Migration and the Florida real estate market is trying to figure out what is to come. According to Mike Simonsen with Altos Research, inventory and demand have divided the national housing market in two.

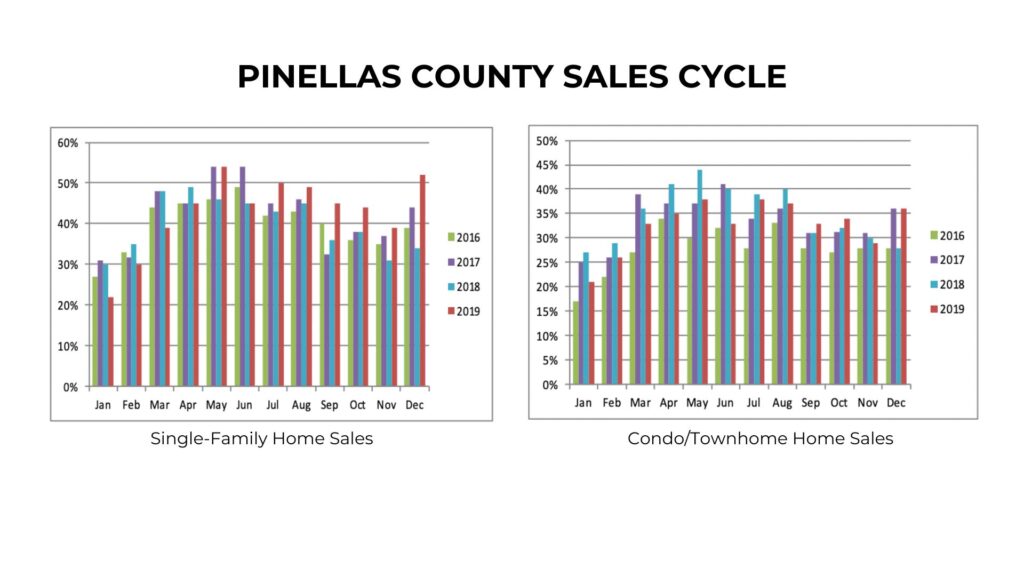

With migration out of the equation, it is important to look back at our traditional seasonal market. The chart below shows the pre-pandemic sales cycle for Tampa Bay. Our local sales cycle has been traditionally dependent on two main factors:

It is still too early to tell how the end of the Great Migration will play out for the Tampa Bay real estate market. We will be watching the numbers closely and report back each month with our findings.

In the wake of Hurricane Helene and ongoing market challenges, it’s natural to wonder about the state of distressed sales in the Tampa Bay area. For the purpose of this article, we are classifying short sales and foreclosures as distressed sales. Here’s what the numbers reveal:

November Distressed Sales:

Pending Distressed Properties in Pinellas:

Active Distressed Listings:

Affordability? Interest Rates? Housing Prices?

These are all factors impacting the rate of home sales in today’s market but distressed sales are a reflection of things that happened in the past.

Life events, not storms, are the major factors impacting the number of distressed sales. The distressed properties currently listed were purchased as far back as 1994, with the most recent being in 2023. Life, death, and financial setbacks are the driving factors behind distressed sales, not hurricane-related damages.

While distressed sales are a reflection of past circumstances, they offer valuable insight into broader market trends. We will continue watching how distressed sales play a part in our Tampa Bay real estate market with economic pressures from interest rates, inflated home prices, and the speculation for more distressed sellers in the aftermath of the storms.

As discussed, there are several factors at play with no clear vision of the future. One thing you can rely on, we will dig into these numbers each month and report back to you. Keeping our finger on the pulse of the ever-changing market is what we do at The Tenpenny Collection. If you’re curious about how these trends might affect your real estate goals, we’re here to help you navigate the evolving market with clarity and confidence. Contact us today for more insights about your real estate questions.