Dealing with 2 storms was bad enough. Now, many homeowners in our area are trying to navigate their options. In this post we will explain the following:

FEMA 50% Rule vs. 49% Rule

What the City of St. Petersburg is doing

Current Market Statistics

Additional Options for You

Each County must uphold specific criteria to protect NFIP funds. The counties and municipalities must enforce these regulations in order for our community to receive federally-backed flood insurance, grants, and disaster assistance. Failure to uphold the NFIP standards means we all lose!

To find more information visit the City and County websites

The City of St. Petersburg is actively working to support homeowners and speed up this process, despite the challenges:

Permit Fee Waivers: Unlike some surrounding areas, St. Pete has waived many permit fees to help ease the financial burden.

Increased Permitting Resources: Additional staff and resources have been allocated to the permitting office to expedite processing.

Updated Information: The city has been diligent in updating their website with critical information to keep residents informed about next steps.

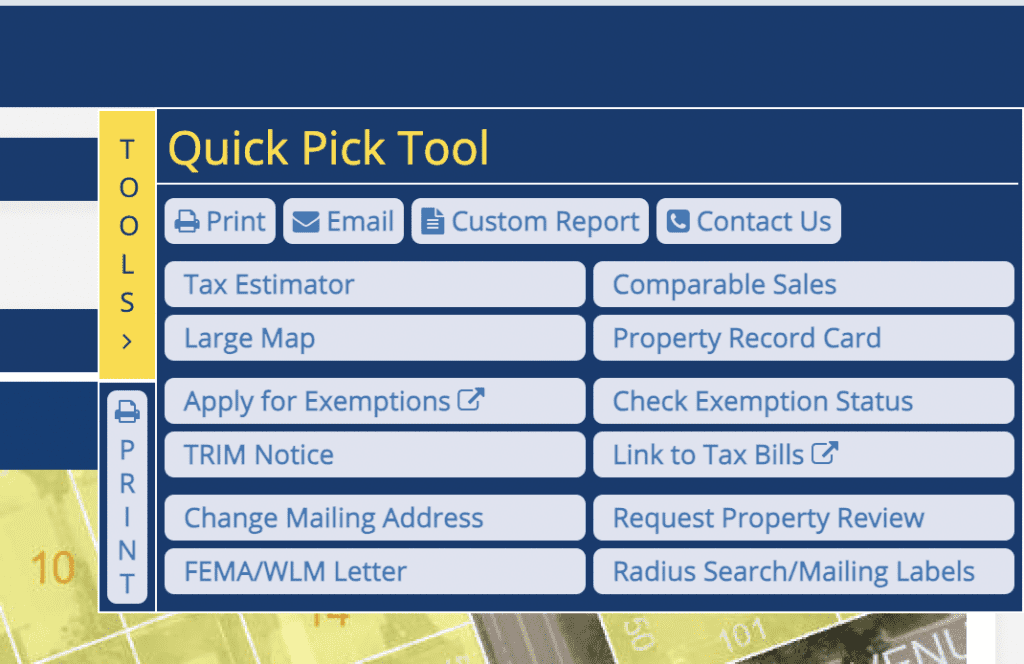

Pinellas County has assigned FEMA structure values to all properties in flood-prone areas. Here’s how you can find your structure value and substantial improvement limit:

Visit pcpao.gov

Search for your property by address.

Select “Tools” from the menu.

Choose FEMA/WLM Letter.

Your FEMA letter will provide you with the value allocation at 50% of your structure’s value. The sentence can be located in the middle of the letter and reads as follows:

“The preceding value allocation to the structure would allow improvements not to exceed $___________ based on the ‘50% Rule.'”

The City of St. Petersburg has opted to enforce a stricter 49% Rule to safeguard NFIP funds.

On your FEMA Letter, find your structure value in the sentence above the 50% value.

To determine your improvement cap, multiply the structure value by 0.49.

Here’s an example scenario:

Structure Value: $98,019

Improvement Cap: $48,029 (calculated by multiplying $98,019 by 0.49)

In this example, the substantial improvements of this property can not exceed a value of $48,029. If the costs to renovate exceeds the amount, the property owner will have to bring the home into compliance with FEMA.

We’re here to support you every step of the way—please don’t hesitate to reach out if you have questions or need further guidance.

If your structure value allows you to renovate, you still have several additional options. Are you renovating to move back in or are you renovating and remodeling to sell?

If your goal is to sell, understanding what buyers want in their home purchase will be an important aspect. From design elements to the highest return on your money, we are here to provide FREE consultations. Our goal is to help you maximize your profit!

Selling your property at land value might be a practical solution for some. Your land’s worth combined with any insurance payout could make this a viable option.

Right now we are seeing land values hold strong and we have not seen any “fire sales”. However, there are many bottom-feeders out there looking for deals. If you have an offer on your property and you would like a professional to review it, please give me a call. I am not an attorney. I am a real estate expert and this is a FREE service! There are aspects of the offer that might need to change to help protect you and your equity.

For those without a mortgage, building on your land may offer a stronger return on investment than selling at land value. We have relationships with quality builders offering excellent products at competitive prices, along with access to favorable construction loan resources. If you’re interested in discussing the numbers and exploring your building options, we’re here to help.

If you have a mortgage, your mortgage company will not allow you to tear down their collateral. Fortunately, we have a resource for new construction loans that will pay off your existing mortgage and provide the funds to build a new home.

First of all, I would like to acknowledge your frustrations and grief! Your home has been flooded, you’ve lost so much, and now you want to move forward. We are here to help! In the past 6 weeks, I’ve personally helped clear out over 30 properties. I’ve visited with countless neighbors and answered numerous questions.

Our goal is to be a trusted resource. We care about our neighbors and we want to help you make the best financial decisions during these difficult times. We are inspired by the resilience of our community and look forward to helping you build back better! You can call us directly at (727) 308-1669 or email Rachel@TheTenpennyCollection.com