The housing market rollercoaster of the past couple of years has many wondering what to expect in 2024. Let’s quickly look at the 4 factors you can expect to affect the 2024 Housing Market.

#1: Housing Shortage

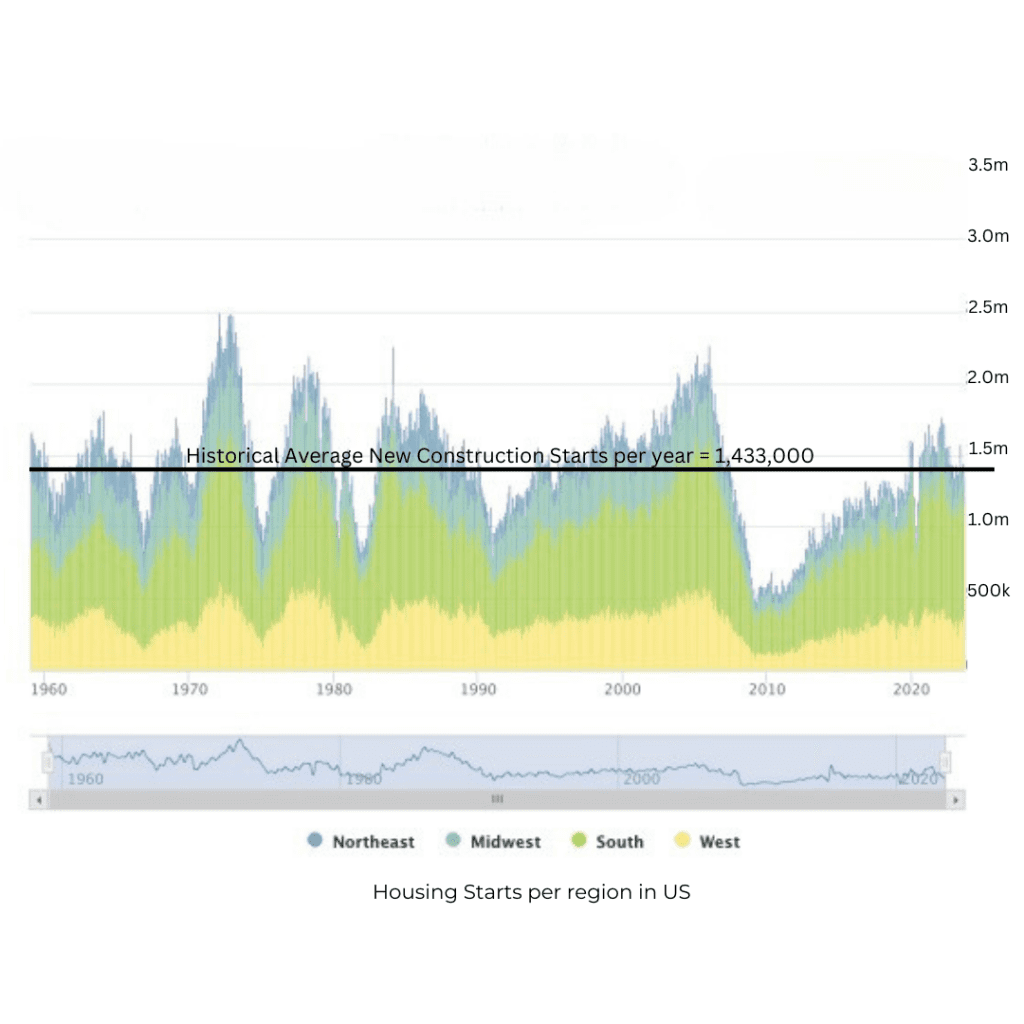

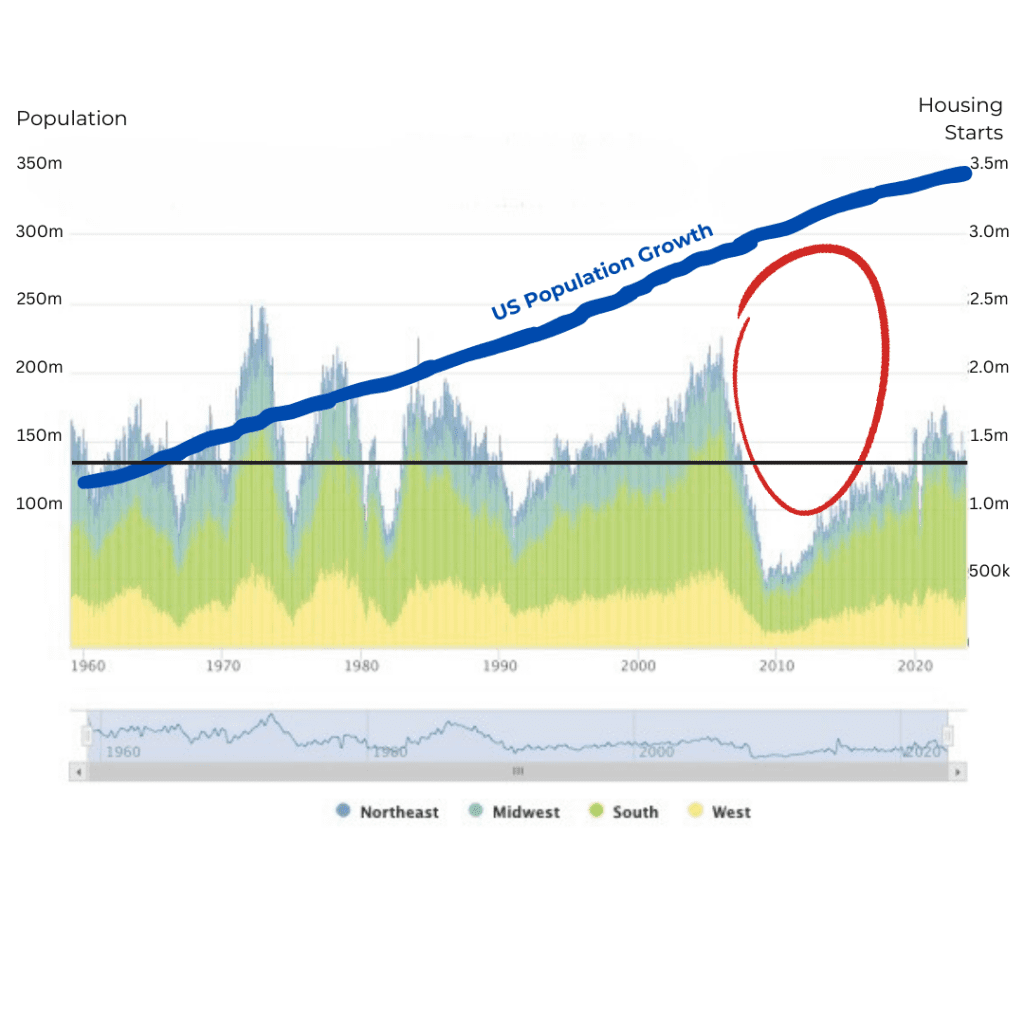

At the onset of the Great Recession, builders pulled out of the market (or went bankrupt). The lowest number of housing starts occurred in April 2009 with only 478,000 units. Housing starts remained around this level for 2 years. Over the next decade, housing starts gained traction but remained under the historical average.

The chart below shows the number of housing starts (new construction) in the US from 1959 – 2023. The average number per year is 1,433,000.

#2: Millennial Demand

While our country was recovering, 72 million Americans entered the home-buying arena. Yes, that is right, Millennials. The population of Millennials now exceeds the number of Baby Boomers. Millennials took over the workforce, started families, and they want to buy a home.

BUT WE DIDN’T BUILD HOMES FOR THEM!

When we combine the chart above and overlay the US population growth (sources: Housing Starts and Population), you will see the gap. Millennial demand combined with the lack of housing weren’t the only factors creating the pandemic home-buying craze from 2020 – 2022. The ability to work remotely and absurdly low-interest rates added fuel to the fire. All of these factors diminished the housing inventory, causing prices to drastically increase (simple law of supply and demand).

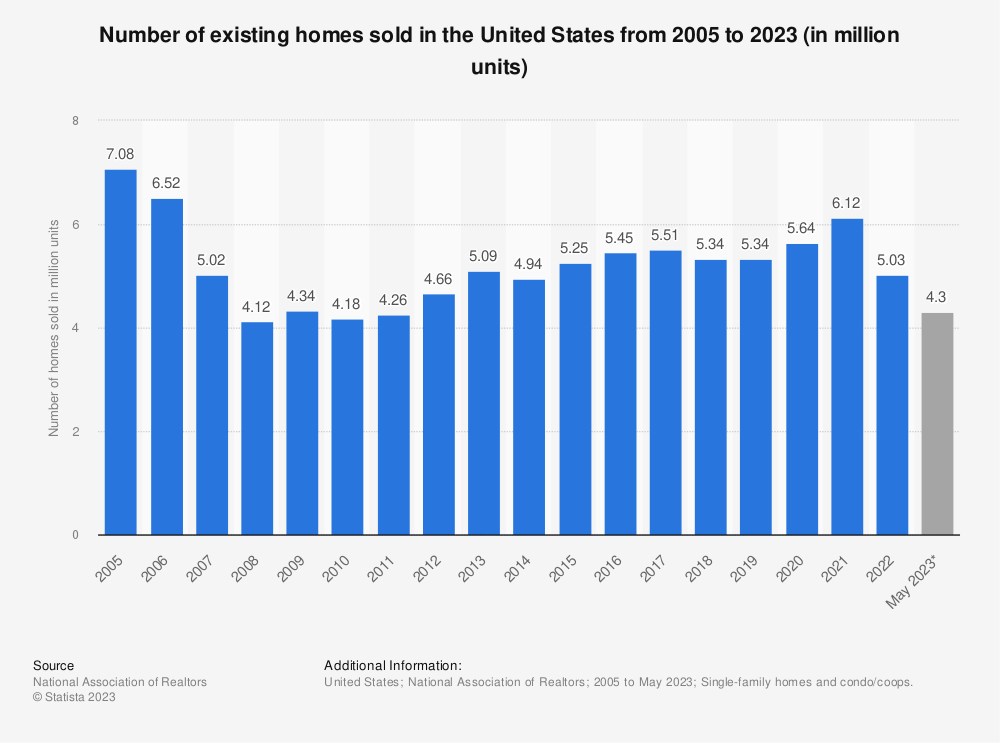

#3 Home Sales

From 2009-2019, there were an average of 4.94m homes sold per year. If we include the pandemic-era sales rate, the average number of homes sold from 2009-2022 has been 5.03m. As of December 2023, there were only 4.09 homes sold in the US. That is almost 1 million fewer home sales than the average! This equates to 1 million buyers sitting on the fence waiting for interest rates and home prices to drop.

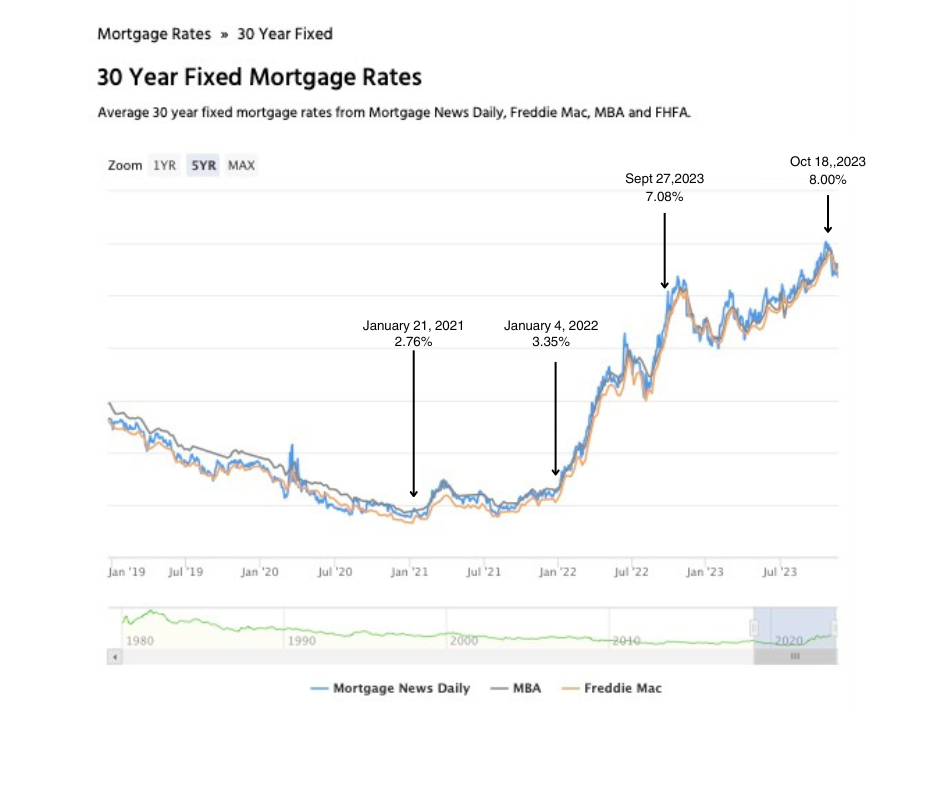

#4 Interest Rates

Remember when we gave out free money? I’m not talking about controversial stimulus checks. I’m referring to 2.5% interest rates on a 30-year fixed mortgage, which only fueled the housing frenzy.

Interest rates are still the star. Yet, they transitioned from Victor to Vilian. The increase in interest rates caused home-buyer demand to tank in 2023. We went from absurdly low to shockingly high rates in a matter of months. In January of 2022, interest rates were only 3%. Within 9 months they hit over 7% for a 30-year fixed mortgage. Home sales were greatly impacted in 2022. This impact continued throughout 2023 as interest rates climbed to a high of 8% in October.

2024 Housing Market Predictions

Interest Rates

Inflation was a given with the years of excess money flying around. Now the US inflation rate is moving closer to the Fed’s goal and experts are predicting interest rates to land in the 6% range for 2024.

Return of Buyer Demand

The home-buying goals of one million buyers didn’t fade away. Instead, potential homebuyers sat on the sidelines. They renewed their leases and hoped for a hail mary – rates to drop and home prices to drop. The hail mary has been thrown but it was a settle pass that many have overlooked. So far this year, the 30-year fixed interest rate has decreased steadily and is now hovering in the high 6% range. The US median home price has also dropped from its high of $479,500 in Q4 of 2022. As of the Q2 of 2023, the median price was $418,000 – that’s nearly a 13% drop! However, don’t expect prices to continue to decline. As of the end of Q3 prices creeped back up to a median of $431,000. In 2024, as leases come up for renewal, potential homebuyers will once again consider their options.

Housing Inventory

Housing inventory is expected to improve from its bleak state but do not expect a surge. As of November, there were 754,846 homes available for sale in the US. This is down 34% from the 1,142,966 available homes in November 2019. Many homeowners have been “locked in” to their homes due to low interest rates. It is predicted that 80% of American homeowners have an interest rate below 5%. As interest rates continue to fall into the 6s, more homeowners will loosen the reigns on their locked-in low-interest rates and consider selling their properties.

Negotiations will be the real winner in 2024. Here are a few to expect:

- Contingencies for the sale of the Buyer’s property to be more widely accepted

- Negotiation of List Price by 3-5%

- Seller paid closing costs or rate buy-downs

- Home Buyer warranties

In 2024, I’m predicting these factors will continue to be major players in the housing market. You can expect things a shift into a normalized market with a healthy absorption rate in most markets. The annual sales cycle should also normalize with home sales increasing in the spring through summer and flattening out over the fall/winter. Home prices should also level out with the normal 3-4% annual gains.

Rachel Sartain Tenpenny has been selling real estate for over 20 years in the Tampa Bay market. With a Master’s Degree in research science from the University of Florida, she loves to research market trends and dive into the data. If you have questions about the real estate market, contact Rachel Sartain Tenpenny to guide you through your process.